PAN card issued by the Income Tax Department of India is a mandatory requirement to file Income Tax Returns or to make banking transactions exceeding Rs. 50,000. Moreover, PAN card is also considered as one of the important identification documents for opening a bank account, purchasing a property, investing in mutual funds, applying for a debit/credit card, etc.

With the Income Tax Department’s free and instant e-PAN card facility using Aadhaar based e-KYC, you can secure an e-PAN online in just 10 minutes and without any documentation. Your PAN card application is instantly processed using your Aadhaar card details.

Let us now understand five important things for instant PAN Card Application using Aadhaar Card.

Eligibility for Instant e-PAN through Aadhaar Card

The instant e-PAN is a digital PAN card that is equally valid as a physical PAN. However, there are a few prerequisites that you must consider if you wish to avail an instant e-PAN:

- You have never been allotted a PAN card

- You should not be a minor on the date when requesting your instant e-PAN

- You should have a valid Aadhaar and a mobile number linked to Aadhaar

- Your complete date of birth should be available on your Aadhaar Card (DD/MM/YY)

- You should not be covered under the definition of Representative Assessee u/s 160 of the Income Tax Act

Get FREE Credit Report from Multiple Credit Bureaus

Check Now

How to Get Instant e-PAN through Aadhaar Card

Here is a step-by-step guide on how to avail Instant e-PAN through Aadhaar card:

Step 1: Visit the e-Filing portal homepage and under the Quick Links section, click on the “Instant e-PAN” option

Step 2: On the e-PAN page, click on “Get New e-PAN”

Step 3: Next, enter your 12-digit Aadhaar number, select the “I confirm” checkbox and click on “Continue”

Step 4: Click on “I have read the consent terms and agree to proceed further” and click on the “Continue” button

Step 5: Fill in the 6-digit OTP sent on your Aadhaar linked mobile number, select the checkbox to validate the Aadhaar details with UIDAI and click on “Continue”

Step 6: On the Validate Aadhaar Details page, select I Accept that checkbox and click on “Continue”. Note that, validating your email address (registered with your Aadhaar) is optional.

Step 7: After successful submission, a success message is displayed on the screen along with an Acknowledgement Number. Do keep a note of the Acknowledgement ID for future reference. You will also get a confirmation message on your mobile number linked with Aadhaar.

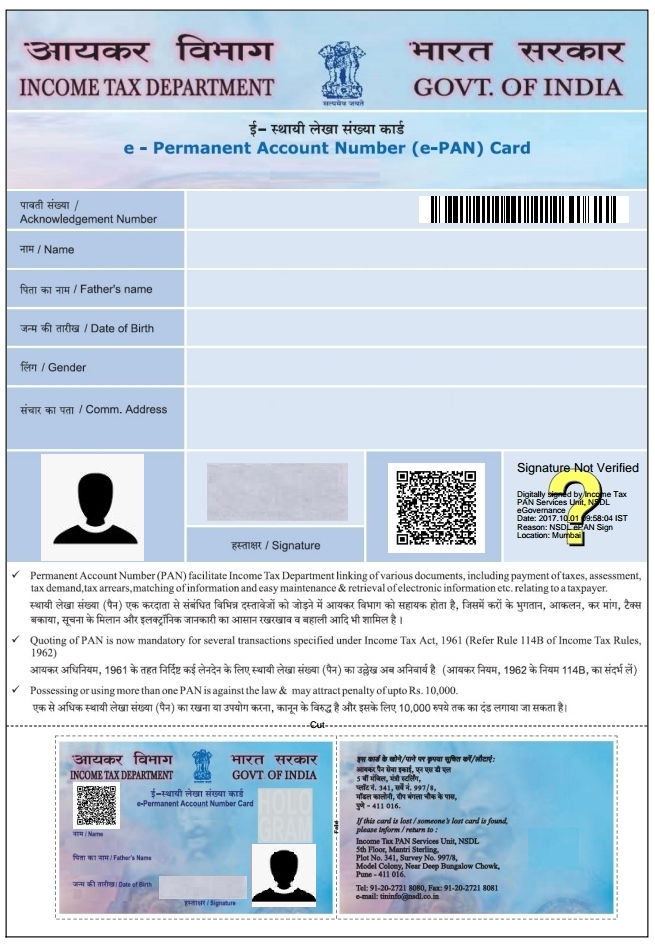

Format of Instant e-PAN Card

The issued instant e-PAN Card is in PDF format which also has a QR code containing all the demographic information such as your name, date of birth, gender and photograph too. Moreover, this instant e-PAN can be downloaded using the 15-digit acknowledgement number sent to you on your registered mobile number and email address once the process of PAN Card application is completed. Moreover, you will also be sent a soft copy of your PAN Card on your email address (if registered with Aadhaar Card and mentioned in the application form).

Note: Sometimes, the applicants get confused whether the instant e-PAN is considered equally valid or not, but as per the recent rules of the Income Tax Department of India, the e-PAN is equivalent to a physical PAN Card.

Charges for Instant e-PAN Card through Aadhaar Card

You can get an instant e-PAN completely free of cost through the Income Tax e-Filing website using an Aadhaar e-KYC based process. However, this instant e-PAN is a digital PAN. To avail a physical PAN card, you need to visit the official website of NSDL or UTIITSL and apply for the same by paying the applicable PAN card application fees and charges.

Read more about: PAN Card Fees and Charges

Documents Required for Instant PAN Application

There is no documentation required for the instant PAN application facility through Aadhaar Card as the data is automatically fetched from UIDAI’s database once you enter your Aadhaar number.

Get FREE Credit Report from Multiple Credit Bureaus

Check Now

How to Check Status of Instant PAN Application

You can also check the status of your Instant e-PAN application by following the steps mentioned below:

Step 1: Visit the e-Filing portal homepage and click on “Instant e-PAN”

Step 2: On the e-PAN page, click on “Continue” under the “Check Status / Download PAN” option

Step 3: Enter your 12-digit Aadhaar number and click on “Continue”

Step 4: On the OTP Validation page, enter the 6-digit OTP that you receive on your Aadhaar registered mobile number and click on “Continue”

Step 5: You can view the status of your e-PAN request on the “Current status of your e-PAN request” page. If your new e-PAN has been generated and allotted, click on “View e-PAN” to view or “Download e-PAN” to download a copy of your PAN card.

FAQs

Q. Can I get hardcopy of instant e-PAN?

No, instant e-PAN is only a digital PAN card. In case you wish to avail a physical PAN card, you need to apply for the same through NSDL (Protean) or UTIITSL website by paying the applicable fee.

Q. Can I get the instant e-PAN issued in the digilocker app?

No, instant e-PAN can only be issued through the income tax e-Filing website.

Q. Does UMANG app support the e-PAN facility?

Yes, you can use your instant e-PAN on the UMANG app

Read more about: UMANG App : Download, Registration, Login, Services & Benefits

Q. Can I provide my instant e-PAN for opening a new savings account?

Yes, the instant e-PAN is equally valid as a physical PAN card.

Q. Will my instant e-PAN be valid for applying for loans and credit cards?

Yes, you can use your instant e-PAN to apply for loans and credit cards.

Q. What will happen to my instant e-PAN if I apply for the hardcopy of PAN card through NSDL or UTIITSL portal?

You can continue using your instant e-PAN as it is. The hardcopy generated is simply a physical form of the same PAN.

Q. Can I use my instant e-PAN for identity proof?

Yes, you can use your instant e-PAN as an identity proof.

Q. Can I use my instant e-PAN for address proof?

Yes, instant e-PAN can be used as a valid address proof.